A note on eurozone money supply growth

I’m not the sort of monetarist who focuses on money supply growth rates, even though I believe changes in the money supply drive nominal aggregates. The reason is that modern central banks tend to adjust the money supply to offset monetary demand shocks. On the other hand I don’t regard the money supply as endogenous, because they don’t fully offset money demand shocks. Nominal aggregates do change.

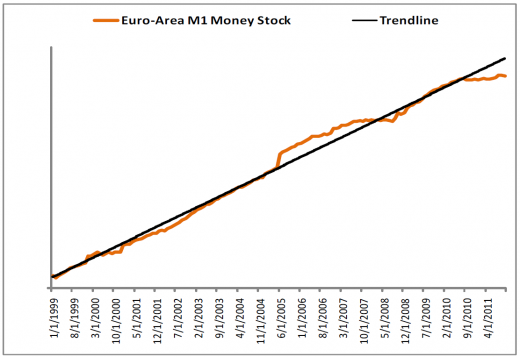

When I was about 17 I read something by Milton Friedman that had a profound effect on my subsequent development as a macroeconomist. He was discussing the super-neutrality of money, and pointed to one exception; changes in the money supply growth rate will end up changing the rate of inflation, and hence the real demand for money. He showed with some ingenious graphs what would happen if a central bank suddenly slowed the rate of inflation, say from 5% to 0%. This was pre-rational expectations, so he assumed they simply slowed the money supply growth rate. That would lower inflation and raise the real demand for money. Now the central bank could temporarily raise the money supply growth rate to accommodate the public’s higher real demand for money, without triggering higher inflation. But once they had satisfied the demand for higher real cash balances, they’d have to go back to the slower money growth rate, and maintain the lower rate indefinitely. The transition period would probably involve a recession. So it’s slower money growth, followed by a spurt of faster growth, followed by slower growth. That’s what it looks like when the central bank shifts to a lower expected rate of inflation (or NGDP growth, as I’d prefer.) Keep that in mind as you examine this graph, from a study by Michael Darda:

Notice how money growth slows sharply in 2007-08, then a severe recession drives interest rates close to zero, then monetary growth temporarily soars at the end of 2008, and then in recent years it settles to a new and much slower growth rate. The “new normal” in the eurozone.

So the last 5 years show exactly the M1 growth pattern that Milton Friedman suggested (way back around 1970) that you would see if a central bank shifted to a lower trend rate of inflation.

BTW, I feel that my awareness of the super-neutrality of money inoculated me against Keynesian macro, which is what I was taught as an undergrad at Wisconsin. I kept asking (to myself): “If there’s an AD problem, an NGDP problem, why not just increase the money supply growth rate?” A few years later old Keynesianism was dead, as the new Keynesians basically adopted Friedman’s insight. And if a central bank was bound and determined to resurrect old Keynesianism, there is no better way than to drive interest rates to zero and simultaneously institute labor market distortions that raise the natural rate of unemployment.

Sorry for that boring trip down memory lane, Michael Darda’s comments are much more interesting:

As the chart to the right shows, the run on Spanish and Italian debt markets began soon after the ECB began to hike rates. Now, with debt markets under immense strain and inflation expectations collapsing, the Wicksellian natural interest rate has likely collapsed to levels well below where it was this spring, meaning the ECB will have to be much more forceful in easing policy than it was in tightening it if it hopes to get in front of the curve. Taking rates down in 25-basis-point “baby steps” is highly unlikely to suffice at this point.

As we noted yesterday, market-based indicators of inflation risk in the eurozone have collapsed. This is a problem because of the real exchange rate misalignment in the eurozone (i.e., peripheral costs are high relative to core costs): The lower the rate of inflation in the core, the higher the rate of deflation in the periphery. We can see this starkly now in the behavior of German and Italian breakeven inflation spreads: As the German five-year breakeven spread has collapsed to below 1%, Italian breakeven spreads have plunged into negative territory. The ECB’s monetary errors are now creating the real risk of a deflationary collapse in the periphery, meaning that no amount of austerity would be able to balance budgets or reduce deficits.

The surge in corporate bond spreads in the eurozone now suggests that nominal GDP could plunge by 3%-6%, which would be a disaster for both peripheral and core budgets.In short, credit markets have tightened massively in the eurozone; if the ECB does not act in a resolute enough manner to offset this tightening (and, so far, it has not), then it will have to shoulder the blame for presiding over perhaps the largest monetary catastrophe since the 1930s.

And yet most pundits keep focusing on side issues, such as rising government default risk, fiscal austerity, bailouts, fiscal union, eurobonds, etc.

Macroeconomics is normally quite difficult. When NGDP is growing at a steady 5% rate, then macro is like a plate of spaghetti; a dizzyingly complex set of interactions at various financial, economic and political levels. But when monetary policy goes seriously off course, then macro becomes incredibly simple. It’s the falling NGDP, stupid.

Fix that, and only the complicated problems remain!

Tags:

29. November 2011 at 13:52

It’s amazing that even last Sunday Draghi was commenting on “the need to maintain the ECBs credibility” – apparently completely unaware that, from the market’s standpoint, their credibility has already collapsed. Market expectations for inflation in the euro zone as a whole are nowhere near their stated target of “slightly below” 2%. If the market doesn’t believe that you will hit your own target, how can you possibly claim to be credible? This is insane.

29. November 2011 at 14:29

Allow me to link a paper (that I have sent you by mail last week) that shows (page 12, the last one) M2 for 4 Euro Area countries (Germany, Italy, Greece, Ireland). The picture is much more frightening than M1 for Euro Area, especially for Greece and Ireland.

http://dl.dropbox.com/u/23191237/niurong.pdf

29. November 2011 at 16:31

Gregor, Yes, it’s becoming increasingly surreal.

Antoine, Thanks for linking to that paper. There is clearly a run on the Greek banking system.

29. November 2011 at 17:38

I don’t really doubt you. But it appears that the equity markets do. Since you’re a much bigger believer in the predictive power of markets than I am how do you explain the disconnect?

It doesn’t seem like equities are pricing in either a six percent drop in NGDP or the likely fallout from such fall.

29. November 2011 at 18:00

OGT, have you looked at the European bank stocks lately? Or US banks for that matter…..

29. November 2011 at 18:14

The biggest problems are usually the simplest and easiest to fix. They’re also often the most-ignored. Maybe it’s a psychological quirk (or maybe it’s Homo hypocritus doing what it does best).

29. November 2011 at 18:53

OGT, Good point, but how far below the 2011 peak are German and French stocks? Isn’t it still pretty far down? And the recessions are likely to be even steeper in the PIGS.

But I linked to this because it was interesting, not because I have strong views on his 3% to 6% NGDP decline prediction. (And not he said “could plunge”)

I think the markets believe it is still possible to stave off the worst case (no long and variable lags) and I agree.

I’m sure all the sophisticated European policymakers would view my blog as being laughably naive, just as Friedman and Schwartz would have been viewed that way if they went back in a time machine to 1931.

30. November 2011 at 02:16

My god, those Italian breakeven charts are awful.

Interesting that M2 and MZM growth in the US has been so strong this year yet velocity has been crashing. In the UK we have weak (barely positive) broad money growth but velocity has been on an consistent upward trend since the start of QE in 2009 (no link for that sorry).

30. November 2011 at 04:53

Britmouse,

Velocity has been on an upward trend (even if one uses adjusted M4) but it fell dramatically in Q2 2011, which was probably the key motivation for our QE2.

30. November 2011 at 05:02

Scott,

The best part of the post was the trip down memory lane. I would like to read the Friedman article my self and use it in my clases. Can you provide a reference? Thanks,

Alejandro.

30. November 2011 at 05:24

Wow! Finally.

http://www.businessinsider.com/fed-ecb-boj-boe-snb-bank-of-canada-announce-coordinated-intervention-2011-11

“FLASH: The Fed and World Central Banks Coordinate to Lower Pricing on U.S. Dollar Swap Arrangements; Futures Soar

By CRONKITE – Wed Nov 30, 2011 8:01am – 2 Comments – 39 views”

This to me is signalling the ECB may be getting ready to do some of it’s own easing monetarily.

It’s big news in the markets.

30. November 2011 at 05:35

Scott,

So I have a hard time exactly understanding the phenomenon you describe from a mechanical point of view. Presumably, if the Fed made a gradual shift, it avoids this type of hysteretic effect. I’m not sure what is so significant about this observation. It seems like this type of phenomenon is extremely common in all types of situations. Not trying to nitpick, but just wondering if I missed something.

30. November 2011 at 08:32

scott,

if money is neutral in the long-term, how is ecb buying going to solve real-side problems? is your argument simply that ecb buying will allow time to sort out the real-side problems? or you just don’t think there are any real-side problems?

30. November 2011 at 18:20

Britmouse and W. Peden, It’s been a long time since I thought about the aggregates, so I can’t recall now the difference between the way M1 reacts to the cycle and the broader aggregates.

Alejandro, Sorry it’s been 40 years and I don’t recall. Perhaps it’s in one of his books of collected monetary articles.

Joe2, Yes, I did a post.

dtoh, I guess my point is that this is the sort of effect you’d expect to see if the Fed adopted a highly destructive monetary policy in the midst of a debt crisis.

mmj, I think there are plenty of real problems, but also plenty of nominal problems due to sticky wages and nominal debt contracts.

If you solve nominal problems, sometimes it’s easier to solve real problems like addressing the deficit problem.