Many commenters have great difficulty understanding my views on foreign policy. I presume this is because many (most?) commenters think this way: “Sumner said X. People who say X usually believe Y. Therefore Sumner thinks Y”. That might work for most people, but it doesn’t work for me. Actually, my views on foreign policy are boringly conventional and quite moderate:

1. Some of my commenters accuse me of being a bloodthirsty warmonger, because I support NATO. I.e., I think we should go to war against Russia if they invade Estonia. I also think we should go to war against China if they invade Japan or Australia, due to our defense treaties with Pacific powers. I like mutual defense treaties among countries that have their act together. AFAIK, it’s the only “foreign policy” that seems to consistently work. They are one of humanity’s greatest achievements.

2. Another group of commenters think I’m a lily-livered, Neville Chamberlain appeaser, because I don’t wish to go to war against China over Taiwan or Xinjiang.

3. Another group thinks I don’t care about human rights abuses in foreign countries, even though I passionately care about human rights abuses in foreign countries—far more than 90% of Americans, and infinitely more than Trump—who is quite upfront about not caring at all. Reading about the Rohingyas and the Yazidis literally brings tears to my eyes. I care so much about foreigners that other commenters say I’m not patriotic enough, putting the interests of the most oppressed people in the developing world ahead of red-blooded Americans. I can’t win.

4. Another group claims I don’t believe that distinct regions should be free to secede from larger entities, even though I’ve expressed support for peaceful examples of secession, as with the Czechoslovakia. They confuse my statements about the current agreed upon rules of international law (no secession without consent) with my personal views as to what sort of world would be best. My claim that Taiwan would be foolish to secede from China without their permission, thereby triggering a horrific war, makes me a Chinese apologist in their view. Taiwan already has all the advantages of de facto independence, and is fortunately too smart to take the advice of my rash commenters (safely out of harms way) and commit mass suicide by seceding. While I have no problem with the idea of an independent Taiwan achieved peacefully with Beijing’s consent, the US should tell Taiwan “If you formally secede, you’re on your own.” I’d guess we already have. And in any case, Taiwan is currently doing fine. If it ain’t broke, don’t fix it.

Are there other occasions where you might want to use military force, beyond mutual defense treaties? As a utilitarian I cannot say there are no circumstances where military force is appropriate, but I’m generally almost as skeptical as Bryan Caplan. Perhaps military force should be used to stop extreme human rights abuses like genocide. But how many now favor a US invasion of Myanmar, where the government is massacring the Rohingyas? There are enormous practical problems with that policy option. Saddam Hussein had an appalling record in many different dimensions, and indeed in 2003 I thought there was a pretty good utilitarian case for getting rid of him. (I wrongly assumed a quick war like the 1991 Gulf War.) The 2003 Iraq War obviously turned out to be a disaster, and this has helped to shape my views on foreign policy.

I’m now more skeptical of the hawks than before. History is full of examples where the hawkish stance turned out to be a complete disaster (1914, Vietnam, Iraq War, etc.) Even cases where we had a quick victory (Spanish-American War) look like clear mistakes in retrospect. People often point to 1938 as an example of the doves being wrong. But even there, a hawkish stance by Chamberlain would have merely triggered the “Phony War” portion of WWII a year earlier, resulting in a less clear cut historical record that the Nazis were 100% the aggressors. Would you want a modern Germany full of Germans who feel that Germany was picked on twice? So I still say we should use the military primarily for self (or mutual) defense, and any other use should be exceedingly rare. Countries allowed into mutual defense pacts should be free of ongoing border disputes.

There’s a better case for using economic sanctions as a foreign policy tool. But here again, the historical record is quite unimpressive. Yes, the sanctions against South Africa may have contributed to the end of apartheid. But for every success like that there are far more failures, such as the Cuban sanctions. If you are using sanctions because of human rights abuses in the targeted nation, the goal should be to make the people in the targeted nation better off. Thus it helps if you have popular support, which seems to have been the case in South Africa (but not Cuba.)

As an example, I’d guess that 98% of the Chinese public would oppose Western economic sanctions. The Chinese are very nationalistic and intensely feel the humiliation imposed on them by Western powers in the 19th century. None of that may matter to you, but it will definitely impact the effectiveness of any sanctions that try to force China to change its ways. US sanctions on China will certainly make the US worse off, and certainly make China worse off in the short run, and definitely make China more prickly and nationalistic. For that sort of “human rights” policy to pass the utilitarian test you’d need a series of political changes in China that are about as likely as making a 4 bumper shot in billiards. How’s our previous track record in that regard? In contrast, economic development usually (not always) improves human rights. And yes, Xi Jinping is an exception.

I’m particularly amused by my right-wing friends who are outraged by human rights abuses against Muslims in Xinjiang, but are silent about Modi’s record in India. Or Saudi Arabia’s appalling record in Yemen. Or who had no problem with the US torturing Muslims and imprisoning them without trial. (And no, I’m not saying these abuses were anywhere near as bad–but do you have consistent principles?) Or those conservatives who favor economic sanctions against the Chinese for violating human rights in Xinjiang, but used to complain that sanctions against South Africa under apartheid “hurt the people they were supposed to help”. (A view I held at the time, but now less certain about.) Unlike many people on both the left and the right, I don’t tailor my views to whether the human rights abuses are committed by a right wing or a left wing government.

A better argument for sanctions is as a deterrent to countries that engage in dangerous military behavior. Thus sanctions on Russia were appropriate after they conquered part of the Ukraine, and sanctions on China would be appropriate if they attacked Taiwan without provocation. Perhaps sanctions are appropriate on North Korea; I think that’s a close call.

My views are pretty simple. We should have defense treaties with like-minded countries to deter aggression. Otherwise try to avoid going to war. Trade freely with all nations, except under a few very limited conditions. I have an open mind as to what sort of military behavior or human rights abuses calls for sanctions, but in general I think the bar should be pretty high.

What about non-military predatory behavior, such as what China is accused of? First we need to figure out the facts. The news media has recently reported claims of Chinese spying that turned out to be false. When there is Chinese spying, or related behavior, it should be handled in the same way we’d handle spying from Russia or some other country. Tit for tat is fine. If they punch us, then punch back. But it’s extremely unlikely that a policy such as 25% tariffs on Chinese goods, which was first developed as a weapon to be used to reduce our trade deficit, would suddenly be the appropriate policy for Chinese human rights abuses in Xinjiang, or Chinese spying on US tech firms. What sort of tariff should we have on Vietnam, for its severe human rights abuses? (Vietnam is in many ways the most similar country to China. A reforming communist East Asian country that is growing fast and still has lots of human rights abuses.)

Some regard China as a military threat to the US, which I think is implausible. The combined strength of NATO plus Japan, South Korea, Australia and New Zealand towers over anything else on the planet. These mutual defense pacts are hugely successful and will almost never be attacked by outsiders (except possibly by the accidental launch of nukes or, of course, terrorism.)

To summarize, I’m a utilitarian on foreign policy. Show me evidence that an alternative plan will make the world a better place, and I’ll support it. I’m not an ideologue. But right now the evidence suggests that mutual defense and free trade are generally the best options.

I’m certainly no expert on foreign policy. But when I read some of my commenters, I feel like most other people are even more clueless than me.

One final point. Whenever you read a commenter saying,”Sumner believes . . .” you can be pretty confident that I do not in fact believe what comes next. And when you read, “Because he has a Chinese wife, Sumner believes . . .” LOL.

Update: I recommend this Edward Luce piece in the FT:

In most professions, such a litany of errors would prompt a soul-searching. Heads would roll. Schools of thought would close down. The magic of Mr Trump is that by uniting the elites in revulsion against his abrasive style, he has restored their sense of moral self-belief. Last month, William Kristol, a leading Never Trumper and Iraq war cheerleader tweeted: “Shouldn’t an important foreign policy goal of the next couple of decades be regime change in China?”

On China, Mr Trump and the blob are ominously coming around to the same view — that it must be confronted. They differ on methods. Mr Trump’s critics would prefer the US to build an allied consensus to win the “new cold war.” They dislike Mr Trump’s bilateral pugilism. They also bemoan his obliviousness. How could he have not known of the arrest of one of China’s business stars on the same day he was negotiating a truce with its president?

Yet they concede that Mr Trump has identified the right target. All of which presages danger. Whenever Mr Trump leaves office, the chances are that the blob will find itself back in the situation room. The story of this young century is a series of US blunders that boosted China’s power far beyond its expectations. It would be odd to hand back control to the people who brought this about.

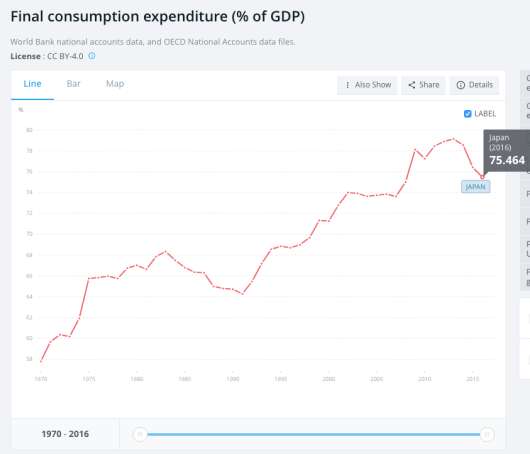

The BOJ should instead adopt a more expansionary monetary policy combined with fiscal austerity. There are many options, including NGDP level targeting. As for the policy instrument, I suggest either exchange rate targeting, or a “do whatever it takes” approach to QE. So far, the BOJ has refrained from either approach. If the BOJ prefers a smaller balance sheet, then they should set a higher NGDP (or inflation) target. And by all means, shift from growth rate targeting to level targeting.

The BOJ should instead adopt a more expansionary monetary policy combined with fiscal austerity. There are many options, including NGDP level targeting. As for the policy instrument, I suggest either exchange rate targeting, or a “do whatever it takes” approach to QE. So far, the BOJ has refrained from either approach. If the BOJ prefers a smaller balance sheet, then they should set a higher NGDP (or inflation) target. And by all means, shift from growth rate targeting to level targeting.