Let’s focus on some good news—air traffic control privatization

Let’s not focus on Trump’s childish, insulting and inaccurate attacks on London’s mayor.

Let’s not focus on the fact that democratically elected leaders almost universally despise Trump, even people who should be his ally (like Theresa May). Or that that Trump only has good relations with bloodthirsty tyrants.

Let’s not focus on Trump’s idiotic “travel ban” tweets, which undercut his own administration.

Let’s not focus on the fact that even conservatives now view him as mentally unstable.

Let’s not focus on how Trump’s foreign policy team was blindsided when he left Article 5 out of his NATO speech.

Let’s not focus on the latest revelations about how the Russians tried to hack the elections, or how Trump tried to cover it up, or how the intelligence services don’t know whether to report info about “bad guys” to their boss, if the boss is very likely to be the bad guy:

These latest revelations may also point to a potential bind that top intelligence officials could find themselves in.

“What do you do if you’re serving the president, and this is information he has to know,” but it relates to a topic in which Trump’s and his associates’ ties are being examined as well, Carle asked.

Law enforcement and investigative officials typically do not inform the subjects of investigations of their findings. “But in this instance, that is the chain of command,” Carle said.

Let’s focus on the positive, Trump’s proposal to privatize air traffic control. Here are a few thoughts:

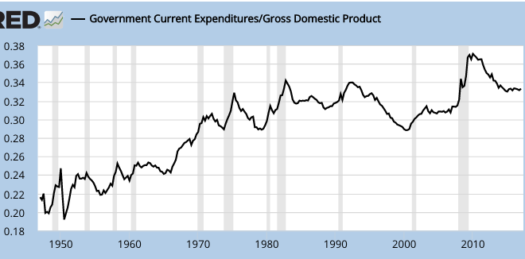

1. When in doubt, the presumption should always favor the private sector over the public sector. There is a mountain of evidence that the private sector is usually more efficient.

2. There may be cases where the public sector is more appropriate. But even in those cases, an independent government-owned corporation may well be better than a government agency that Congress can easily order around. I believe some of the European countries use that model.

3. The pilots and the air traffic controllers favor privatization, an indication of just how outmoded their equipment is.

4. We also need to privatize airports and airport security, a trend where the Europeans are far ahead of us.

Will Trump get this through Congress? I doubt it.

PS. Commenter Alexander Hamilton directed me to a letter signed by lots of economists, supporting Labour in the current British election campaign. For those who don’t know, the current leaders of the Labour Party are big fans of people like Castro, Trotsky and Lenin. Their favorite policies are similar to those that Chavez used to turn Venezuela into a basket case. So what sort of economists are fans of this madness?

Dean Baker, Co-Director of the Center for Economic and Policy Research, Washington, DC

James K. Galbraith, Professor of Government, University of Texas, USA

Simon Wren-Lewis, Professor of Economic Policy, Oxford University

Trump and Corbyn. Both the left and the right seem to have gone completely insane. Is it something in the water?