Here’s Adam Ozimek:

Guest-posting at The Dish, Elizabeth Nolan Brown has an interesting piece up discussing prostitution and pornography that is worth ruminating on. She writes:

Last night, a close friend told me he had been reading my posts about decriminalizing sex work. “I’m sympathetic,” he said, “and I want to agree with you. But I just keep thinking, ‘what if it were my daughter?’ That’s, like, every father’s worst nightmare.”

Brown goes on to rebut her friend by pointing out that if your daughter did become a prostitute, you’d want it to be legal because that makes it safer. While she is right about that, I think it gives her friend’s argument too much credence. The more important thing her friend is missing is this: this is a country of free people, not your children.

Whether you’d want your kid to do something is a terrible, selfish, and self-centered way to think about policy.

Ozimek also links to Damon Linker:

There’s just one complication to this happy story: no one, or almost no one, actually believes it. People may say they see nothing wrong with or even admire Weeks’ decision to become a porn actress, but it isn’t unambiguously true. And our ease of self-deception on the matter tells us something important about the superficiality of the moral libertarianism sweeping the nation.

How do I know that nearly everyone who claims moral indifference or admiration for Weeks is engaging in self-deception? Because I conducted a little thought experiment. I urge you to try it. Ask yourself how you would feel if Weeks “” porn star Belle Knox “” was your daughter.

I submit that virtually every honest person “” those with children of their own, as well as those who merely possess a functional moral imagination “” will admit to being appalled at the thought.

Linker also has this to say:

None of this should be taken to mean that I favor banning porn or making it illegal to work in the industry that produces it. In the end, I’m a libertarian, too.

I can think of four ways of looking at the daughter test. It will help to first consider a couple hypotheticals. Say you and your family go back in a time machine to the late 1800s, but still have your modern 21st century attitudes toward behavior. How would you feel about your daughter walking along the beach in a bikini? During the Victorian era that sort of behavior would be viewed as a disgrace, and your daughter would no longer be accepted in respectable society.

Also consider how you’d feel if your daughter dropped out of high school and spent her adult life cleaning toilets at Penn Station.

Now let’s form some categories:

1. One might regard certain behavior as immoral, and favor making it illegal. You wouldn’t want your daughter doing that. Ms. Brown’s friend has that view of prostitution.

2. You might believe certain behavior is immoral, but also believe it should not be illegal. You wouldn’t want your daughter doing that. Mr. Linker has that view of porn.

3. You might believe certain behavior is not immoral, but wouldn’t want your daughter doing it because she would be shunned by polite society. Others view it as immoral. That’s my hypothetical of the 21st century father transferred into the Victorian era.

4. You might regard certain behavior as perfectly moral and even necessary, but wouldn’t want your daughter doing that because society views the job as rather dirty, degrading and low class. That’s my example of cleaning toilets.

So I can think of at least 4 cases where someone might feel really upset to find out their daughter ended up in a certain career, each having very different implications. In other words, I’m not a fan of the daughter test. That’s not to say the test doesn’t occasionally reveal hypocrisy on the part of people, especially men, and especially about sex. It does. But it’s very hard to draw any implications from these intuitions, especially if you are a moral realist (which I am not.) Indeed the Victorian era raises some uncomfortable issues for moral realists.

PS. If you insist on asking parents what they would think of their children doing something, then FOR GOD SAKE DON’T ASK AMERICAN PARENTS. Reason just ran this story:

A whopping 68 percent of Americans think there should be a law that prohibits kids 9 and under from playing at the park unsupervised, despite the fact that most of them no doubt grew up doing just that.

What’s more: 43 percent feel the same way about 12-year-olds. They would like to criminalize all pre-teenagers playing outside on their own (and, I guess, arrest their no-good parents).

Those are the results of a Reason/Rupe poll confirming that we have not only lost all confidence in our kids and our communities””we have lost all touch with reality.

“I doubt there has ever been a human culture, anywhere, anytime, that underestimates children’s abilities more than we North Americans do today,” says Boston College psychology professor emeritus Peter Gray, author of Free to Learn, a book that advocates for more unsupervised play, not less.

I’ve talked to both European and Asian parents about this, and both seem to think American parents are utterly insane in their attitudes toward leaving children unattended. Do we really want to rely on the moral intuitions of crazy people?

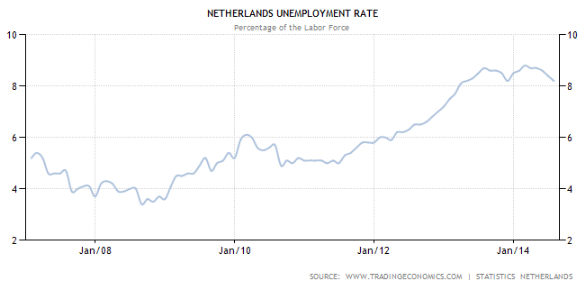

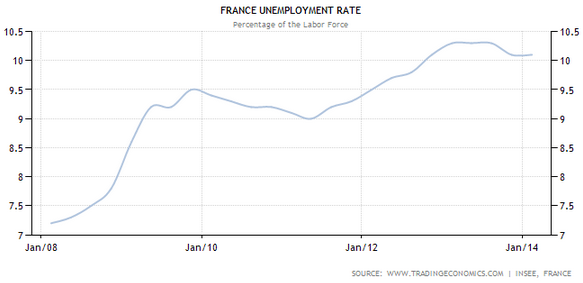

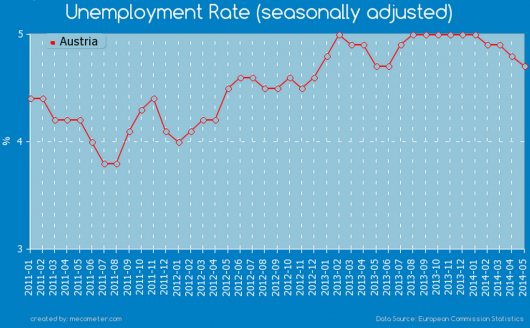

So the Netherlands, France, Belgium and Austria also had double-dips. The Dutch double-dip was worse than the first dip. The ECB caused the double-dip recession—even new Keynesian models will tell you that. (After all, the ECB raised rates twice in 2011, so this wasn’t one of those zero bound issues.) Odd that Draghi doesn’t understand that the ECB caused the NGDP growth collapse, and that debt crises are the result of NGDP growth crashes. That doesn’t make me very hopeful that the eurozone’s long nightmare will end anytime soon.

So the Netherlands, France, Belgium and Austria also had double-dips. The Dutch double-dip was worse than the first dip. The ECB caused the double-dip recession—even new Keynesian models will tell you that. (After all, the ECB raised rates twice in 2011, so this wasn’t one of those zero bound issues.) Odd that Draghi doesn’t understand that the ECB caused the NGDP growth collapse, and that debt crises are the result of NGDP growth crashes. That doesn’t make me very hopeful that the eurozone’s long nightmare will end anytime soon.