So I see that despite the “Great Recession,” they have to pay blue collar workers $112,000/year to get them to get off their ass and go work in N. Dakota:

What has that brought to North Dakota?

Jobs, money, and people. The state now has the lowest unemployment rate in the country, at 3 percent. Its oil industry employs almost 41,000 people, plus 18,000 jobs in peripheral industries. For those working in the “Oil Patch” in the western part of the state, the average annual salary is $112,462. The only requirements to find work are a government-issued ID and a clean criminal record.

And I see that my school district is planning on tearing down perfectly good elementary schools and replacing them with new schools featuring air conditioning.

That’s right, schools not even open during late June, all of July, and all of August . . .

. . . In Massachusetts!

If you live long enough, and if you live in a society where living standards are advancing, you will eventually become a reactionary. I don’t mean a right-winger, although that may come with it, but rather someone disgusted at how soft the newest generation has become.

I saw this happen to my dad, who was a life-long liberal Democrat. I swore it wouldn’t happen to me. But now I’ve become my dad. I just found out from my daughter that the other kids at her school have iPhones. I suppose that’s no big deal, but it astounded me.

I used to let my knee-jerk reactionary tendencies affect my politics, but I’ve worked hard to overcome that problem. Yes, the suffering from unemployment is nowhere near as bad as in the 1930s. Yes, those “without healthcare” get better healthcare by walking into the ER than than Louis XVI had. But there’s no reason why the way things used to be should have any bearing on how we live today. The past is like a sunk cost, it’s irrelevant.

So when my daughter told me that in addition to a cafeteria, her new $200 million high school (which replaced a high school built in the 1970s) has a restaurant with sushi and cinnamon-apple tea, I just had to swallow hard and say “that’s nice.”

And the fact that the unemployed are not really like the 1930s version (which explains why Hollywood doesn’t even try to make films like the Grapes of Wrath anymore), is no reason to support a tight money policy. Excess unemployment still causes suffering, and the world is better off without it.

Anyway, the world is for the young, old guys like me don’t matter.

PS. You know those stories you hear from old people about how they had to walk 2 miles to school each day, through deep snow, in below zero temps (below minus 18 for you international readers)? And the schools never ever closed, no matter how deep the snow? Yup, that’s my childhood in Madison, WI. Being a reactionary may be stupid, but it’s still very satisfying to talk about.

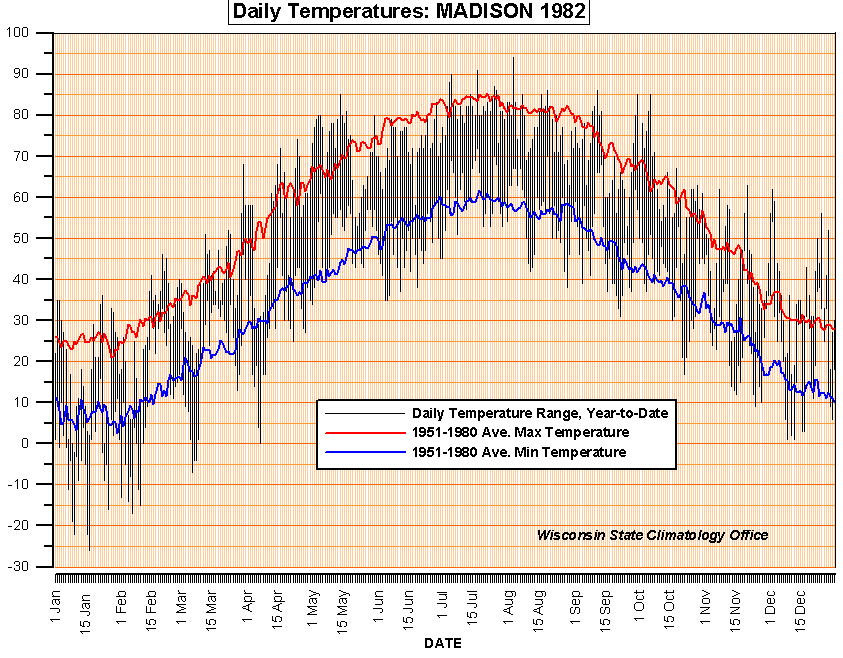

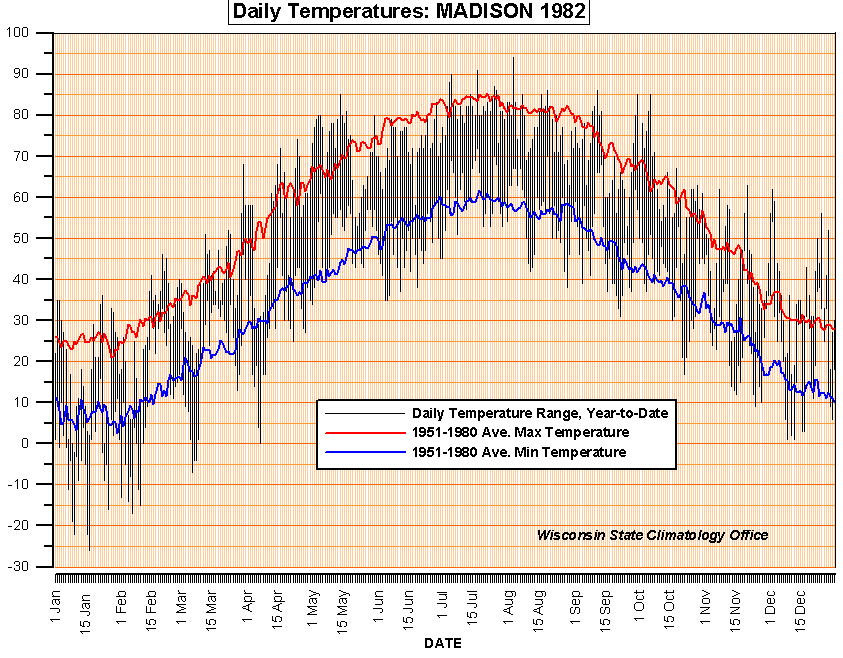

The internet now allows you to verify if your memories were correct. I recall driving from Madison to New York in early 1982, leaving on a morning when it was 26 below zero (minus 33 C?) The chill factor was minus 70. And there it is:

Amazing. And notice the mild summers–global warming really is happening.

PPS. If the past is irrelevant, then we are equally irrelevant to the people living in 2113. They don’t care what we think about morality, public policy, fashion, economics, or anything else. It doesn’t matter what we “decide” about designer babies or anything else. It’s their world. They will view us with contempt. Or with pity. Get used to it.

PPPS. I know an economist who had a tough upbringing. Grew up in a trailer park, broken home, alcoholic dad, etc, etc. He’s conservative. What do I tell him about poverty to get him to change his mind about being a conservative? Do I tell him; “you just don’t understand what it’s like to grow up in a disadvantaged household?” How well do you think that will work? Suppose that growing up he knew other poor kids who chose not to study hard. Kids that were bullies. How would that affect his worldview? As a utilitarian I try to ignore all the emotional framing. You want me to have my heartstrings pulled by some sad story of a poor person? Fine, but then I’ll also let my friend’s story work on my emotions. Which one will win out?

Or shall I try to blot out all the powerful emotional stories on both the left and the right? Use reason and logic. Declining marginal utility of consumption suggests we should do some redistribution, but the powerful effect of incentives on wealth creation suggests we need a quite inegalitarian society, even after we are done.

PPPPS. Now I know I’m getting really out of touch:

The usually dull arena of highway planning has suddenly spawned intense debate and colorful alliances. Libertarians have joined environmental groups in lobbying to allow government to use the little boxes to keep track of the miles you drive, and possibly where you drive them “” then use the information to draw up a tax bill.