Why Bernanke’s debt-deflation article is wrong

Ben Bernanke published an influential article back in 1983, in which he argued that debt-deflation could worsen a depression by reducing bank intermediation. He saw the reduction in intermediation as sort of “real shock,” which could not be completely addressed by easier money (otherwise his model would not have differed from Friedman and Schwartz’s.)

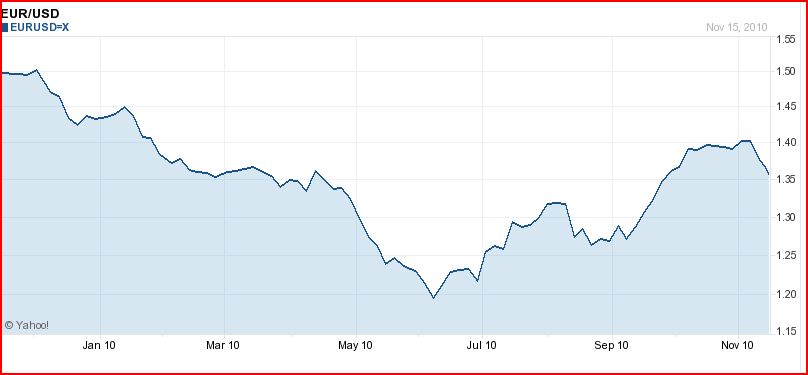

In 2008 he was given a chance few academics ever see—he was allowed to try out his theory on the US economy. The Fed decided to focus on bailing out the banking system in the second half of 2008, rather than adopting an aggressive policy of monetary stimulus. Indeed the famous interest on reserve program of October 2008 was implemented precisely to prevent the injection of funds into the banking system from ballooning the money supply and raising prices. The Fed argued that without IOR the fed funds rate would have fallen close to zero. (The ff target was in the 1.5% to 2.0% range at the time.)

Unfortunately, Bernanke’s theory is based on a misreading of the Great Depression. The bank panics were problematic, but only because they led to monetary contraction. The direct effects were trivial. How do I know this? Obviously I cannot be sure, but consider the following evidence:

1. There were more than 600 bank failures each year during the Roaring Twenties, and yet the economy boomed. Over 950 banks failed in 1926, a relatively prosperous year.

2. The rate of bank failures did increase in the early 1930s, but they were mostly the same small rural banks that failed in the 1920s, and the share of deposits affected was a small fraction of the total banking system.

3. There was one exception, during 1933 bank failures rose dramatically. The deposits of failed banks were 11% of all deposits. Much of the banking system was shut down for many months.

And what happened to the economy during this “mother of all bank panics?” Prices and output soared (as I discussed in the previous post.) This occurred because in 1933 (unlike 1930-32) the bank crisis was not allowed to lead to monetary contraction.

I would never argue that banking problems had zero impact on productivity, but the evidence from the booming 20s, and from 1933, suggests that as long as NGDP is growing, banking difficulties are not a major factor in the business cycle. And we also know that banking problems don’t prevent NGDP from growing. So it looks like Bernanke was relying on the wrong model of the business cycle, and fighting the wrong problem.

The Fed was not trying to raise the rate of inflation during late 2008. Now they are trying to (modestly) raise inflation, up to around 2%. They should have done that two years ago, and they are still likely to fall short of their goal. How do I know? The Fed’s own internal forecasters just issued a new set of macro forecasts, which are essentially telling Bernanke that $600 billion isn’t enough. More is needed.

Part 2. The battle of textbook co-authors

It seems to me that this post loosely relates to the recent back and forth between Tyler Cowen and Alex Tabarrok on the question of whether we’d be better off without the Fed. I don’t have strong views on the question, partly because it’s not clear to me exactly what is being debated. If the counterfactual to no Fed is that we go back to the gold standard, then I vote for the Fed. I don’t wish to rehash the issue of whether the macro economy did better before WWI, or after WW2, and in any case I’m not sure that’s the right question (for instance, almost half the population were farmers in the 1800s–so how can one compare unemployment rates?) Rather I’d like to point out that the Asian boom has just led to a big rise in real commodity prices. If we returned to gold I doubt other countries would follow. And I’m not willing to risk our monetary system on the assumption that somehow one country returning to gold would have prevented that commodity price boom from spilling over into higher real gold prices. Of course a rise in the real value of gold means deflation for any country with a currency pegged to gold.

If the counterfactual is that the Fed is abolished in 2006, and instead the Treasury puts monetary policy on automatic pilot via a NGDP futures targeting scheme, then count me in. Tyler might argue that we’d have been worse off without someone to rescue the banking system. I guess you won’t be surprised to learn that given a choice between stable 5% expected NGDP growth (level targeting) combined with a banking crisis of uncertain size, and collapsing NGDP growth combined with the Fed doing its lender of last resort routine, I’ll take the NGDP target.

Part 3. The paradox of really stupid monetary policy

People have asked me to comment on the new paper by Paul Krugman and Gauti Eggertsson. I’ve just skimmed the paper, but much of it seems to revive the various “paradoxes” that I have often criticized. Their innovation is to directly model the debt crisis.

There’s probably some value in focusing on the debt problem, but I see it as mostly reflecting tight money, not as an exogenous shock. Their counter-intuitive policy advice (savings, wage flexibility are bad) comes from the assumption that the AD curve slopes upward when at the zero bound. This means that if you have wage cuts (or more saving), both prices and output fall. Which means NGDP falls. There are certainly policy regimes where this can occur, and indeed it might have played a role in the 2008 recession. For instance, if the Fed is pegging nominal interest rates and people suddenly try to save more (or invest less), then the Wicksellian equilibrium interest rate will decline. If the Fed continues to hold rates fixed, the money supply will decline, as will NGDP.

But note that this assumes monetary policymakers are stupid. Some might argue that they really are stupid, so the model applies. I think it’s more reasonable to argue that they are occasionally a bit slow to respond, and they sometimes let AD fall more than they should. But any serious discussion of macro stabilization policy that assumes the central bank is hopelessly incompetent is not likely to lead to any good policy options. Who are we supposed to look to for wise policy advice—Congress?

I don’t think money was tight during the German hyperinflation and hence I don’t use interest rates as a benchmark of the stance of monetary policy. I use expected growth in M*V, or NGDP. So when I read Krugman and Eggertsson, I interpret them as saying that more saving or wage cuts might be bad at the zero bound, because it would cause the Fed to tighten monetary policy, i.e. it would lead to lower NGDP expectations. I don’t think that view of the world is capable of providing useful policy advice.

I also don’t think the empirical evidence supports their view of monetary policy, or wage flexibility. The 1921 recession (with flexible wages) ended quickly. The 1930 recession (with very sticky wages) . . . not so well. FDR’s NIRA was a complete disaster. Industrial production had risen 57% in the 4 months before his high wage policy (due to an easy money policy), and then increased not at all for the next two years (until the NIRA was declared unconstitutional.)

I also disagree with Krugman’s interpretation of Japan, having argued many times that:

1. The BOJ said they were opposed to inflation.

2. The BOJ tightened policy to prevent inflation on several occasions during the 2000s.

3. The BOJ succeeded in preventing inflation.

I’ve never understood how those facts show that a central bank cannot create inflation at the zero bound. There are people at the BOJ who are currently warning about the danger of inflation, even as deflation has been accelerating. I know, I’m not sophisticated enough to understand the subtle nuances of Japanese monetary policy.

If the Congress does more saving (i.e. fiscal austerity) the Fed should do more QE, or a lower IOR. That’s the policy mix recently adopted by the British. Is our system in America so inept that we must develop special macro models that rely on our central bankers being more incompetent that the Brits?

Don’t answer that question.

Seriously, part 3 of this post does seem inconsistent with part 1. But don’t we have to work on policy approaches that assume some sort of rationality on the part of policymakers. Yes, the Fed shouldn’t have let inflation fall to 1%, but at least they moved when it did. And what’s our alternative? Does anyone see Fiscal Stimulus II in the near future? At least the Fed is doing something.

Update: People complain that I am too tough on Krugman. But Bob Murphy is even tougher. Here he finds an amusing contradiction.